carried interest tax reform

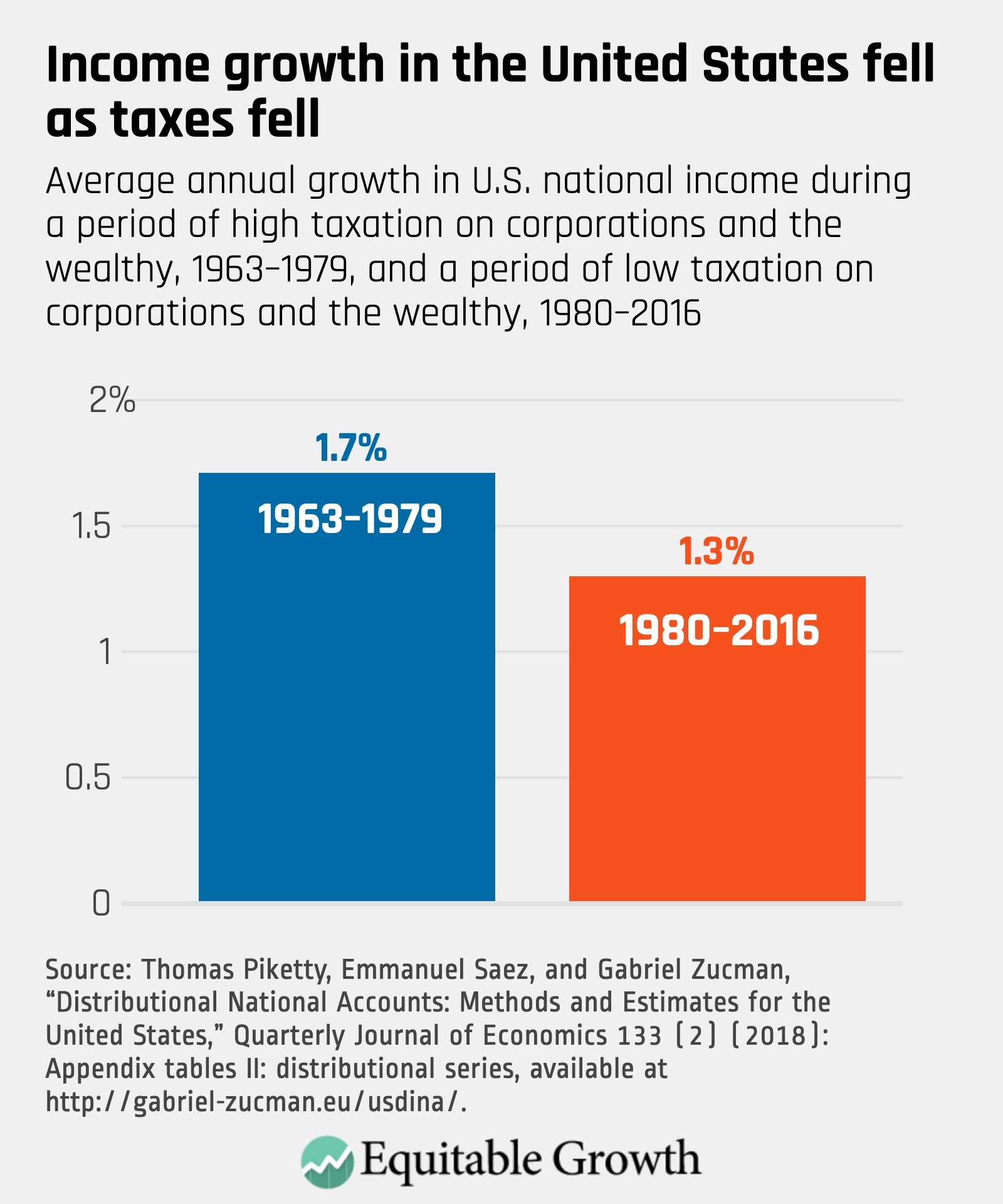

Some view this tax preference as an unfair market-distorting loophole. Carried interest allows hedge funds to evade their tax obligations.

Mixm Io Is A Trusted High Volume Bitcoin Mixer Tumbler Blender Mixing Service With Very Low Fees And It S Own Lar Bitcoin Cryptocurrency Bitcoin Transaction

Trump signed into law in late 2017 when the carried interest rules also known as promote in the real estate community were left mostly intact.

. On July 31 2020 the Treasury Department finally published long-awaited proposed regulations. 115-97 modified the taxation of carried interests by enacting Sec. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

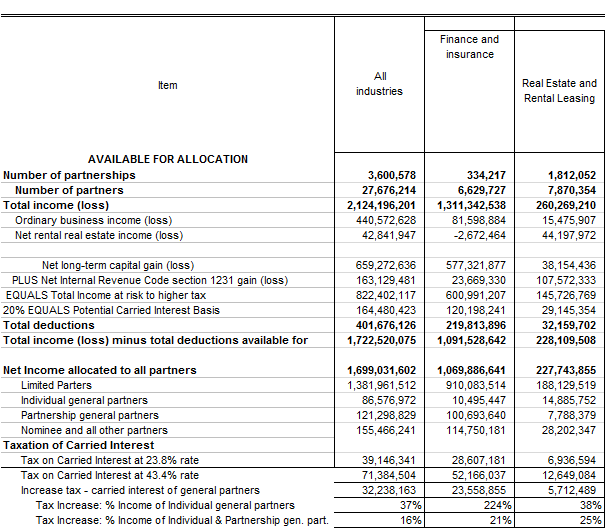

Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. As a goal of tax reform adjusting carried interest has made the rounds on Capitol Hill for years. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers.

The Tax Cuts and Jobs Act of 2017 TCJA enacted legislation to address partnership carried interests. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends and property transferred for services provided.

Carried interest tax reform 2018 Carried interest tcja. The law known as the Tax Cuts and Jobs Act PL. On December 22 2017 President Trump signed into law sweeping tax reform that will generally be effective for taxable years beginning after December 31 2017.

Carried interest tax changes. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. Carried interest tax reform.

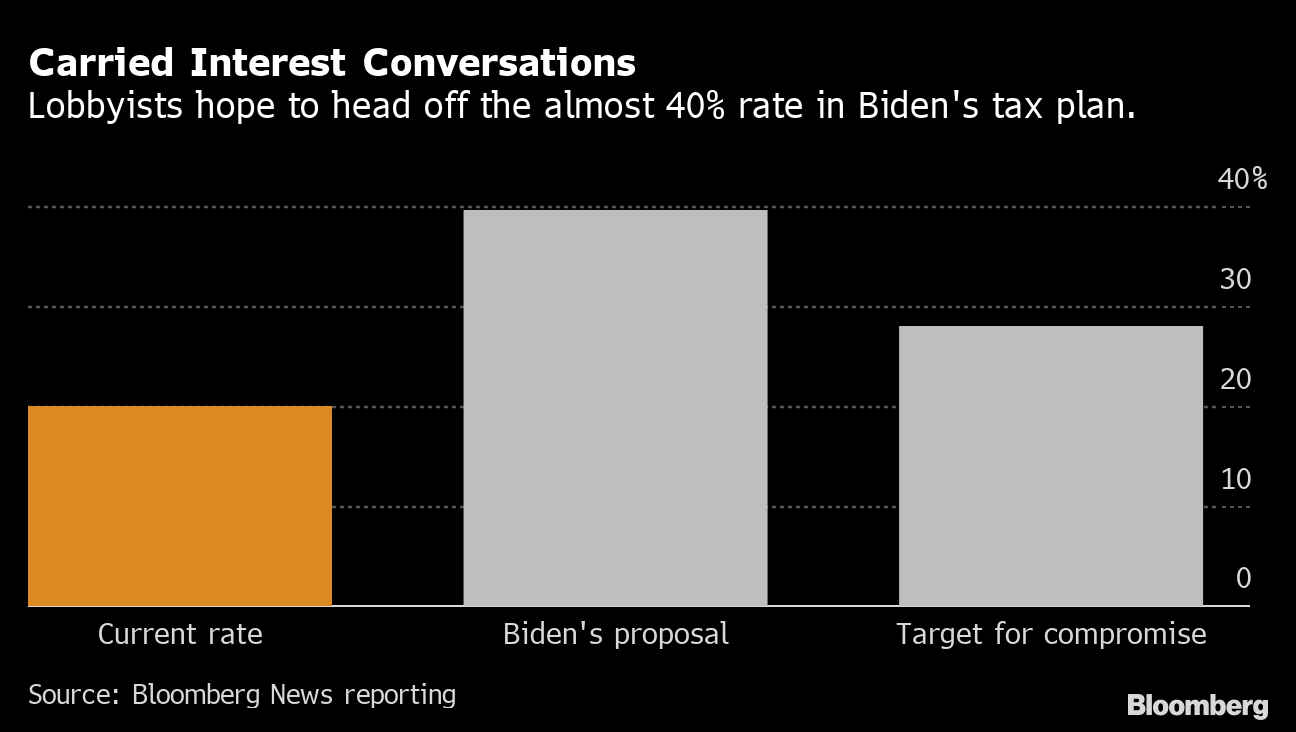

Carried Interest Waivers. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. Following the enactment of the 2017 Tax Reform practitioners considered the ability to use carry waivers as a possible technique to avoid the implications of Section 1061 and often incorporated such.

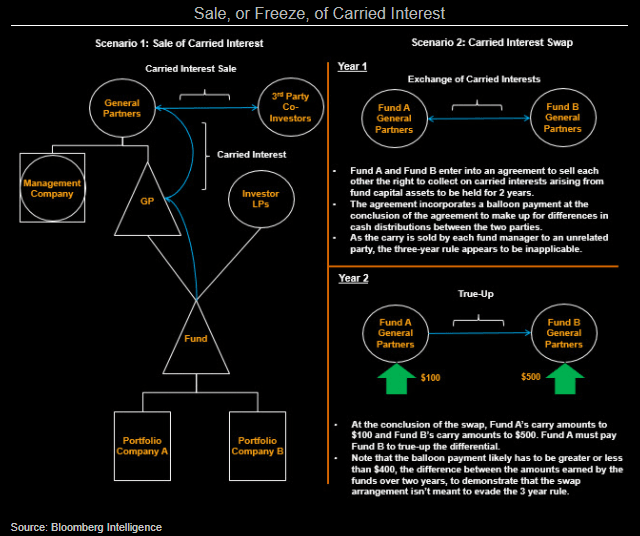

Now that the proposal is once again in. Tax Reform 322021 While the future of carried interest and long-term capital gain tax rates may remain in flux we do have clarity on required holding periods. This Code provision generally says that to qualify for tax-favored long-term capital gains LTCGs treatment certain carried interest arrangements must meet a greater-than-three-year holding period.

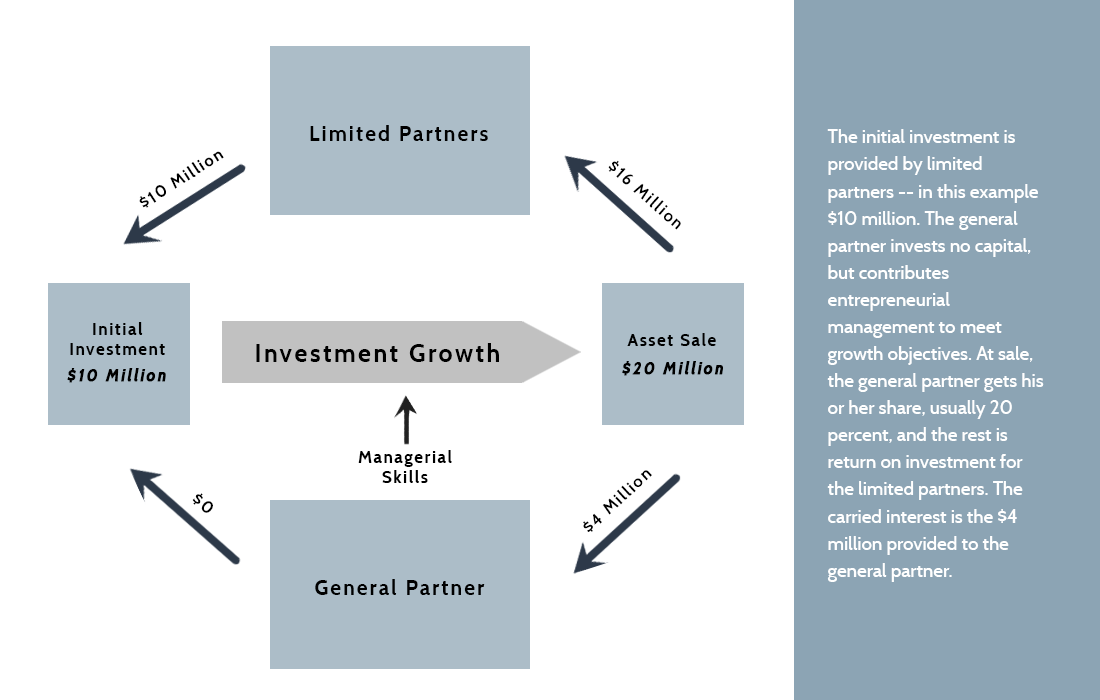

However the bills carried interest provision may directly impact fund managers year-end planning now particularly hedge fund managers. Others argue that it is consistent with the tax treatment of other entrepreneurial income. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax.

In 2014 Ways and Means Committee Chairman Dave Camp introduced a tax reform bill that would have raised rates on carried interest to 35 percent. Earlier versions of Trumps tax reform proposal called for taxing all carried interest at ordinary income rates prompting a massive lobbying campaign by alarmed real. A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it.

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the. By Keefe Borden. Enacted as part of the 2017 Tax Cuts and Jobs Act Section 1061 was the first step taken to curtail the preferential treatment of carried interests.

Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka carried interest held by the sponsors of private equity hedge venture capital and other investment funds that are structured as flow-through entities. There has been criticism in the press that the carried interest. It was somewhat of a surprise in the final legislation President Donald J.

The key change established in Section 1061 is that carried interests must be held for three years rather than the normal one-year period to qualify for long-term capital gains treatment. A proposed change to tax laws for partnerships has drawn stiff opposition from two advocacy organizations for builders. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

This article will address some of the primary considerations for impacted partnerships and taxpayers as the end of the year approaches. 2017 pub 536 page 3 2nd Column If your NOL is greater than the tax revenue of the year to which you carry it figured before deducting NOL you will usually have a NOL Carryover to The following year. 1068 otherwise known as the Carried Interest Fairness Act of 2021 would boost taxes on real estate by requiring carried interest to be classified and taxed as ordinary income rather than as a capital gain.

Fleischers piece which called the treatment of carried interest an untenable position as a matter of tax policy began a heated debate in Congress and tax policy circles on the topic. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free loan from the.

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

The Tax Treatment Of Carried Interest Aaf

Duties And Taxes Not Subsumed Into Gst Accounting Taxation Tax Goods And Service Tax State Tax

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

The Tax Treatment Of Carried Interest Aaf

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Deductibility What Is The Best Option For Your Family Office Structure Goulston Storrs Pc Jdsupra

Gst Transitional Provisions Https Taxguru In Goods And Service Tax Gst Transitional Provisions Html Corporate Law Goods And Services Goods And Service Tax

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Lobbying Kept Carried Interest Out Of Biden S Tax Plan Bernstein Says

The Relationship Between Taxation And U S Economic Growth Equitable Growth

The Tax Treatment Of Carried Interest Aaf

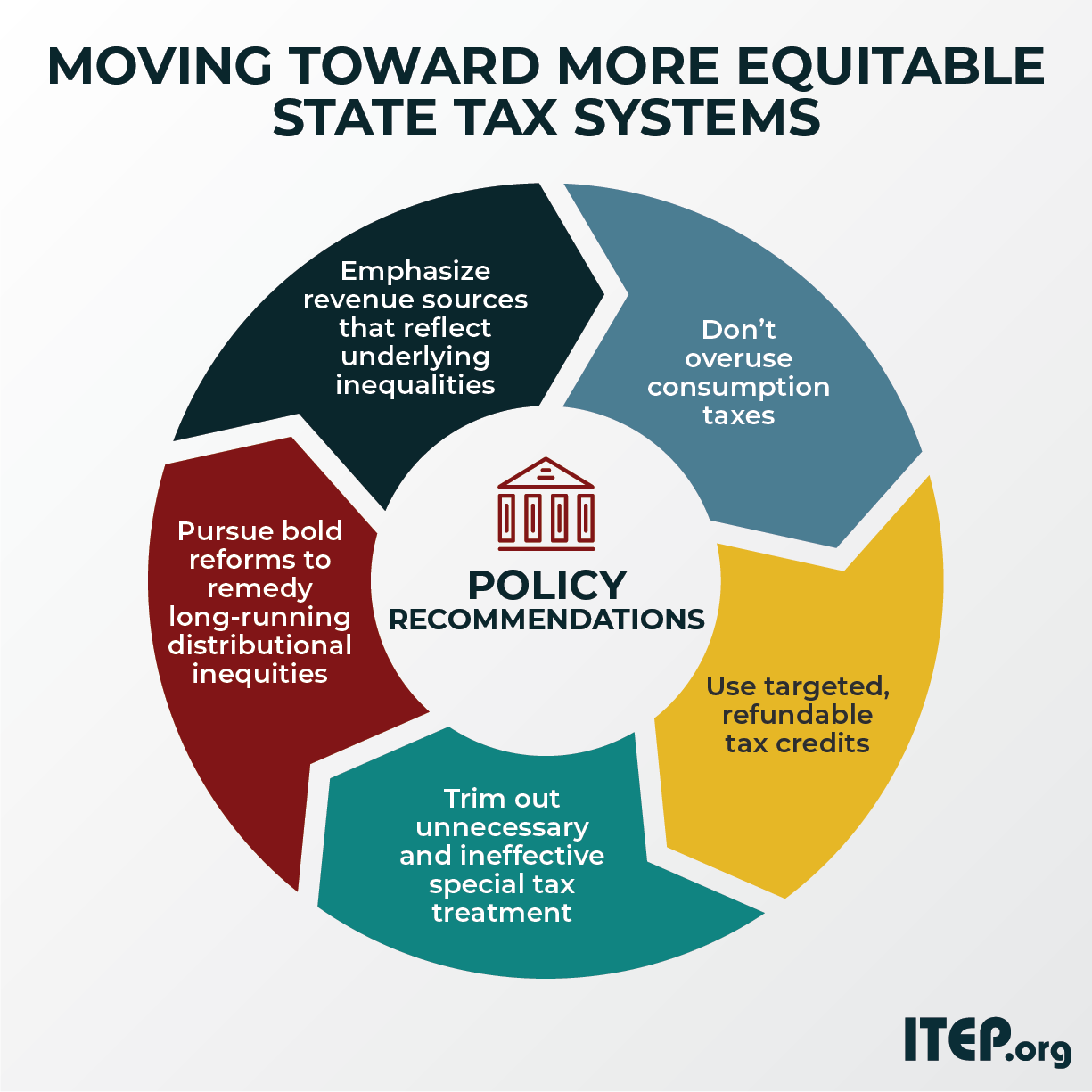

Moving Toward More Equitable State Tax Systems Itep

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Gst Consulting Services Accounting Online Accounting Software Accounting Services

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

The Realty Developers In Yamuna Expressway Have Been Warned By Authorities That No Flats Could Be Booked Or Construction Activities Carried Ou World Agra India

Carried Interest Regulations And The Future Of A Debated Tax Break 2021 Articles Resources Cla Cliftonlarsonallen

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)